Women couldn t submit a credit application at a bank without a man until 1974

Women Couldn’t Submit a Credit Application at a Bank Without a Man Until 1974

Introduction

In an era where gender equality is gaining more prominence, it is important to reflect on the historical struggles women had to face regarding basic rights and opportunities. While progress has been made over the years, it might come as a surprise to many that until 1974, women in the United States were unable to submit a credit application at a bank without the presence or approval of a man.

Historical Background

The roots of this practice can be traced back to early societal norms. In the past, women were often regarded as dependents, primarily relying on male family members, such as husbands or fathers, for financial matters. This belief heavily influenced the banking system, leading to discriminatory practices against women when it came to credit applications.

Limited Financial Independence

The inability of women to submit credit applications independently led to restricted financial independence. A woman’s financial decisions were controlled by men, making it challenging for them to access loans, credit cards, or any other form of credit without male authorization. This limitation hindered women’s ability to establish their own credit history and create economic stability.

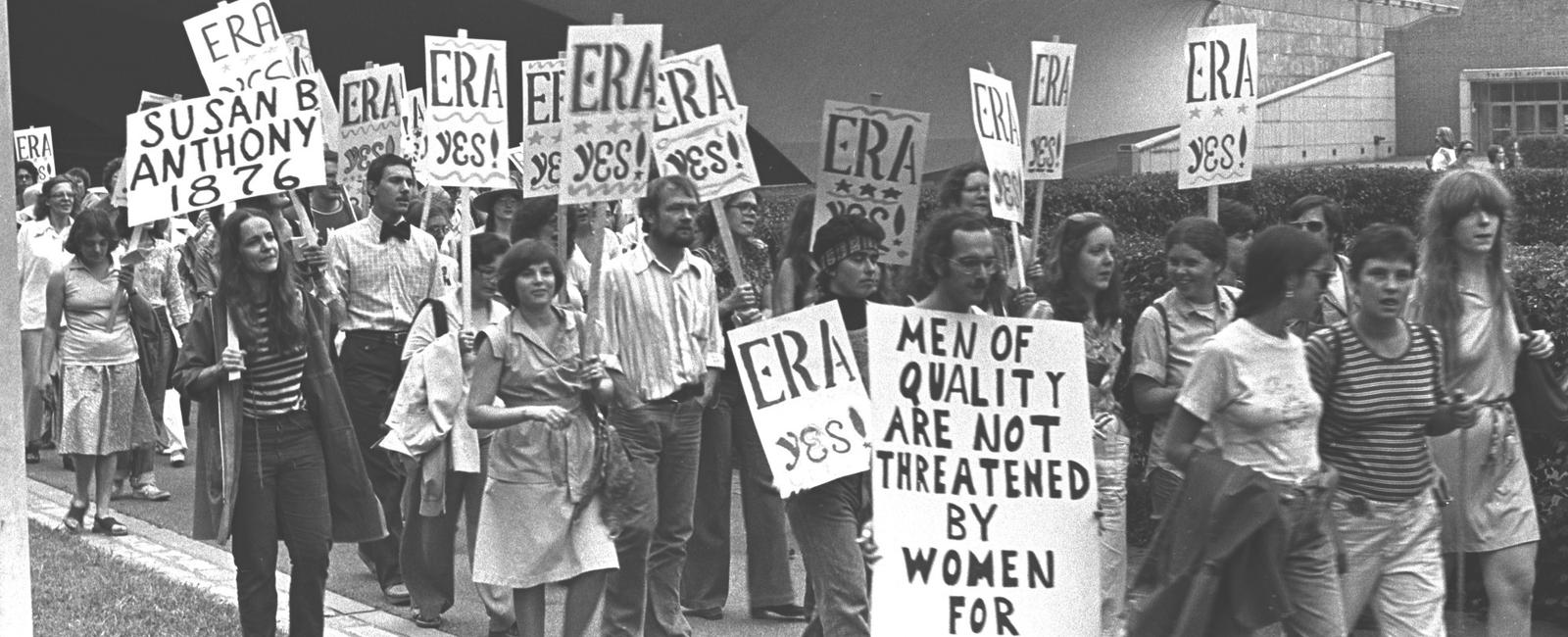

The Fight for Change

In the midst of the growing feminist movement and increasing awareness about gender inequality, women began demanding equal rights, both socially and economically. Organizations, like the National Organization for Women (NOW), advocated for changes in legislation to grant women the same financial opportunities as men.

The Equal Credit Opportunity Act

In response to these demands, the United States government enacted the Equal Credit Opportunity Act (ECOA) in 1974. The ECOA sought to end gender-based credit discrimination, making it illegal for banks and other lenders to treat credit applicants differently due to their gender.

Impact and Progress

The passing of the ECOA marked a significant turning point for women’s rights. It paved the way for women to gain financial independence and end their reliance on male family members for credit-related matters. Obtaining credit and managing personal finances became more accessible, empowering women to make their own financial decisions.

Conclusion

The fact that women in the United States couldn’t submit a credit application at a bank without a man until 1974 highlights the systemic gender discrimination prevalent in society. However, through persistent activism and the enactment of legislative reforms like the ECOA, progress has been achieved in ensuring gender equality in the financial sector. Recognizing this historical context sheds light on the importance of continuing to strive for equal opportunities for all in our present and future.

Tags

Share

Related Posts

Quick Links

Legal Stuff