There are more than 1 6 million atms all over the world

There Are More Than 1.6 Million ATMs All Over the World

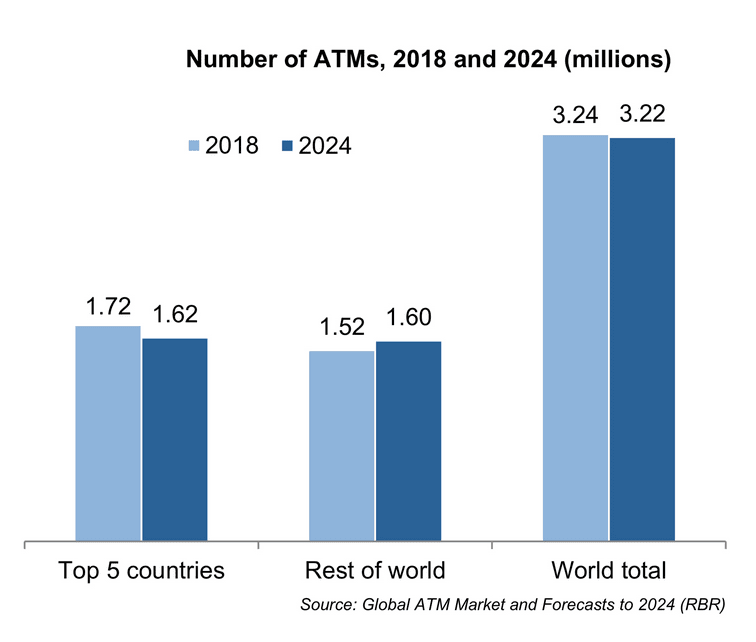

Did you know that there are more than 1.6 million ATMs scattered across the globe? These Automated Teller Machines have become an integral part of our daily lives, offering convenience and accessibility to financial services. Whether you need to withdraw cash, deposit funds, or check your account balance, ATMs are available 24/7, making them an essential tool in modern banking.

According to Statista, a leading provider of market and consumer data, the number of ATMs worldwide has been steadily increasing over the years. This growth can be attributed to the rising demand for efficient banking services and the advancement of technology.

ATMs are deployed in various locations, ranging from bank branches, shopping malls, airports, and even remote areas. This widespread distribution ensures that customers have easy access to their funds regardless of their location. Furthermore, ATMs have evolved to offer more than just cash withdrawal and balance inquiries. Many ATMs now provide additional services such as bill payment, mobile phone top-ups, and check depositing. This versatility makes ATMs not only convenient for users but also cost-effective for banks in handling routine transactions.

With the increasing number of ATMs globally, it is evident that they play an essential role in the financial ecosystem. These machines provide a secure and reliable means for individuals to conduct financial transactions, reducing the need for physical bank visits. Furthermore, the availability of ATMs helps alleviate long queues in bank branches, improving the overall customer experience and reducing operational costs for financial institutions.

However, it is worth noting that despite the convenience and benefits ATMs bring, they also pose challenges in terms of security and maintenance. Financial institutions continuously invest in state-of-the-art security measures to safeguard ATMs from potential threats, such as card skimming or hacking attempts. Routine maintenance and cash replenishment are also crucial to ensure ATMs function seamlessly.

In conclusion, the presence of more than 1.6 million ATMs worldwide has revolutionized the way we conduct financial transactions. From their humble beginnings to their current advanced capabilities, ATMs have proven to be an indispensable tool in the modern banking landscape. Whether you’re in a bustling city or a remote village, rest assured that an ATM is just around the corner to cater to your banking needs.

Source: Statista

Share

Related Posts

Quick Links

Legal Stuff