Greece has been in a state of default for half its modern history as a sovereign state

Greece: A History of Sovereign Default

Greece, a country known for its ancient history, picturesque landscapes, and vibrant culture, has also been plagued by a long-standing issue: sovereign debt default. Over the years, Greece has faced numerous financial crises, leading to a default state that has persisted for half of its modern history as a sovereign state. This article aims to explore the historical context and the factors contributing to Greece’s recurrent default status.

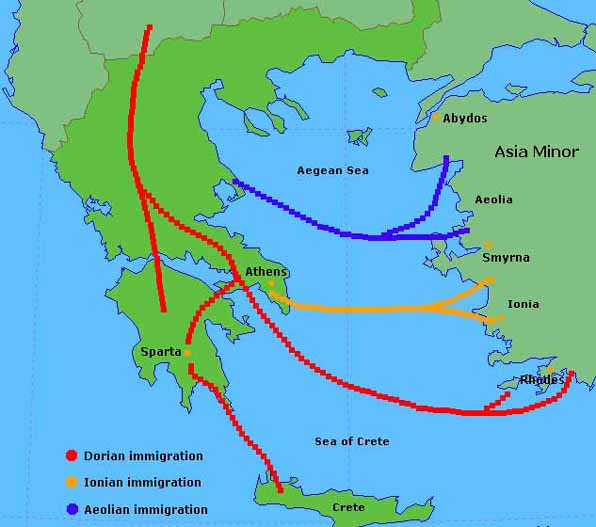

The Origins of Greek Debt Troubles

To fully comprehend Greece’s state of default, we must delve into its economic history. Greece struggled with significant debt burdens long before it became a member of the European Union (EU). In the 19th century, the country experienced various financial crises and defaults, which set the stage for future economic challenges.

During the 20th century, Greece faced upheaval due to political instability, including military coups and civil wars. These internal conflicts hindered economic growth and pushed the country further into debt. The Greek government often resorted to borrowing money to fund its ambitious infrastructure projects, public services, and military expenditures, which only exacerbated its debt burden.

Greece’s Entry into the EU

In 1981, Greece joined the European Economic Community, the precursor of the EU, with hopes of economic prosperity and stability. However, the following decades were marked by inconsistent economic policies, rampant corruption, and a lack of fiscal discipline. These factors, coupled with Greece’s ambitious spending and borrowing practices, eventually culminated in the debt crisis that unfolded in 2009.

The 2009 Debt Crisis and EU Bailouts

The 2009 debt crisis significantly impacted Greece’s economy, leading to a state of default. The country faced skyrocketing borrowing costs, a shrinking economy, rising unemployment rates, and a lack of investor confidence. Greece could no longer meet its debt obligations, triggering a series of bailouts by the EU, the International Monetary Fund (IMF), and the European Central Bank (ECB).

These bailouts were contingent upon harsh austerity measures imposed on Greece, including severe spending cuts, tax increases, and reforms aimed at improving fiscal discipline. However, these measures came at a high social cost, causing widespread protests and exacerbating social inequality.

The Vicious Cycle of Default

Despite the bailout programs, Greece has struggled to break free from its default cycle. The country’s high debt-to-GDP ratio, political instability, and structural issues have hampered its economic recovery. Greece has undergone multiple rounds of renegotiating its debt, experiencing temporary relief, only to face new challenges shortly afterward.

Greece’s sovereign default status has not only affected its own economy but also had ripple effects across Europe. Worries about contagion and the stability of the eurozone have persisted, making Greece’s financial struggles a matter of great concern for the international community.

Conclusion

In conclusion, Greece has grappled with a history of sovereign default, with half of its modern existence as a sovereign state marked by financial crises. Political and economic instability, ambitious spending, lack of fiscal discipline, and austerity measures have perpetuated this state of default. As Greece continues to navigate its economic challenges, finding a sustainable solution remains crucial not only for the country itself but also for the overall stability of Europe’s financial landscape.

Source: Armstrong Economics

Note: The images used in this article are for illustrative purposes only and do not imply any endorsement.

Tags

Share

Related Posts

Quick Links

Legal Stuff