The first credit card was used in the united states in 1920

The first credit card was used in the United States in 1920.

The concept of credit cards has become an integral part of our daily lives. It allows us to conveniently make purchases without carrying cash. But have you ever wondered where it all began? The first credit card was used in the United States in 1920, marking a revolutionary milestone in the history of financial transactions.

According to the Encyclopedia Britannica, the idea of a credit card was initially developed by individual firms as a way to foster customer loyalty. However, it was Frank McNamara and Ralph Schneider who took this idea to the next level by introducing the first universally accepted credit card.

In 1950, McNamara, the head of the Hamilton Credit Corporation, and Schneider founded Diners Club International. Their vision was to create a card that customers could use to make purchases at various establishments. Initially, they targeted a select group of restaurants, but soon expanded to hotels and travel agencies.

The credit card they introduced had a limit of $200 and was primarily made out of cardboard. It required members to settle their bills within 30 days. Although this concept was met with skepticism in the beginning, it quickly gained popularity.

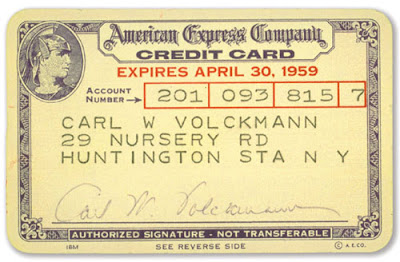

Diners Club International’s success paved the way for other companies to enter the credit card market. American Express introduced their charge card in 1958, followed by BankAmericard (now Visa) in 1959 and Master Charge (later renamed Mastercard) in 1966.

With the rapid expansion of credit card usage, financial institutions started incorporating technological advancements to enhance security and convenience. Magnetic stripes were introduced in the 1970s, followed by the infamous “chip and pin” technology in the 1990s. Nowadays, contactless payments and digital wallets are pushing the boundaries of how we make transactions.

The first credit card used in the United States in 1920 set the foundation for a financial revolution that continues to shape our lives today. It introduced the concept of convenience and paved the way for countless advancements in the field of electronic payments. Whether it’s buying groceries, booking flights, or shopping online, credit cards have become an essential tool in our modern world.

Sources:

Share

Related Posts

Quick Links

Legal Stuff