Americans have an average of 4 credit cards per person

Americans have an average of 4 credit cards per person

In today’s digital age, credit cards have become an integral part of our financial lives. From making online purchases to earning rewards, credit cards offer convenience and benefits that many Americans find hard to resist. According to a study by CNBC, the average American holds a staggering 4 credit cards.

Having multiple credit cards has become a norm among Americans. Gone are the days when people relied on a single card for all their financial needs. The availability of various credit card options and attractive offers have enticed individuals to explore different cards for different purposes.

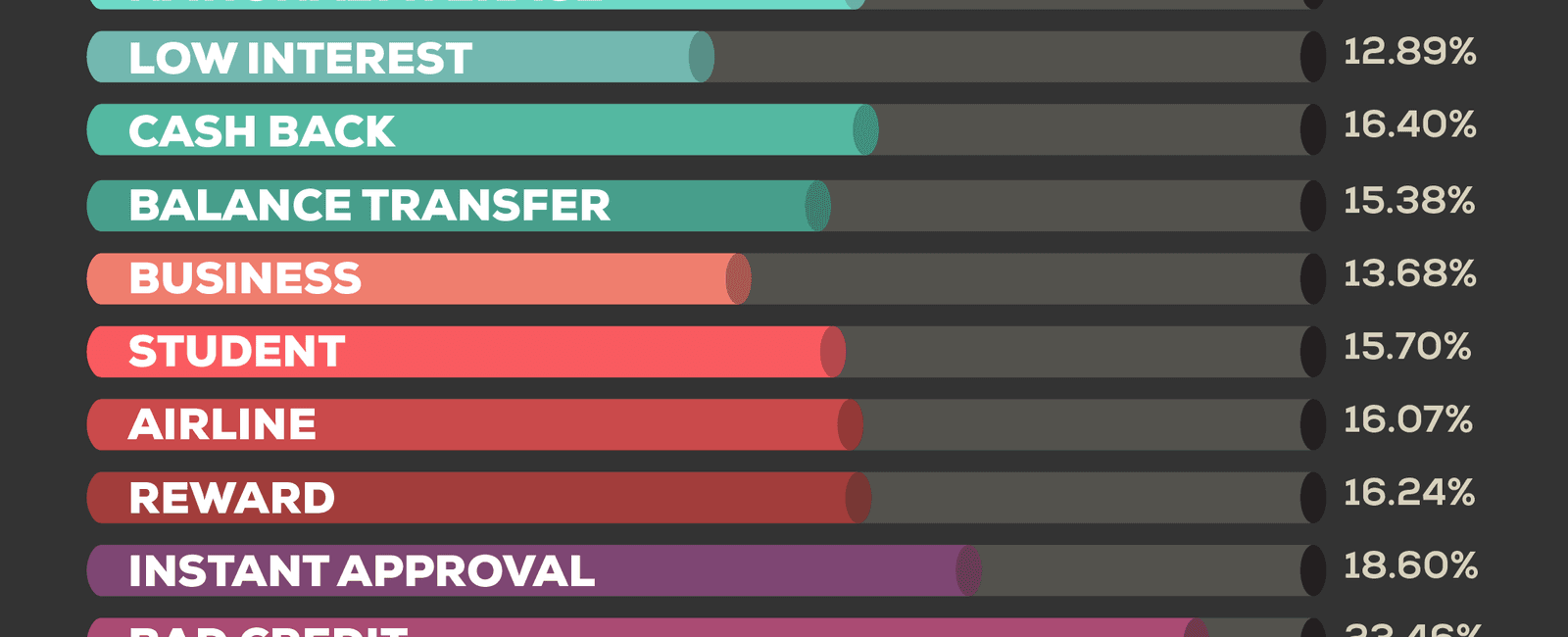

One of the primary reasons why people maintain multiple credit cards is to maximize their rewards and benefits. Each credit card comes with its own unique set of rewards, such as cashback, travel points, or discounts on specific purchases. By strategically using different cards for different expenses, individuals can make the most of these rewards and save money in the long run.

Apart from rewards, Americans also use multiple credit cards to manage their expenses and maintain a healthy credit score. By dividing expenses across different cards, individuals can distribute their credit utilization and keep it below the recommended threshold, which positively impacts their credit score. Additionally, having multiple cards allows individuals to have a backup in case one card gets lost, stolen, or compromised.

While multiple credit cards can offer advantages, it’s crucial for individuals to manage them responsibly. Keeping track of multiple due dates, monitoring spending habits, and avoiding unnecessary debt are essential practices to maintain a healthy financial life. It’s important to remember that having more credit cards also means more temptation to spend beyond one’s means, which can lead to financial troubles if not managed properly.

To sum up, it is evident that Americans have embraced the idea of owning multiple credit cards. With the increasing number of options available, individuals are leveraging the benefits, rewards, and convenience that come with having multiple cards. However, it is important to use credit cards responsibly and maintain a well-balanced financial lifestyle.

Source: CNBC

Share

Related Posts

Quick Links

Legal Stuff