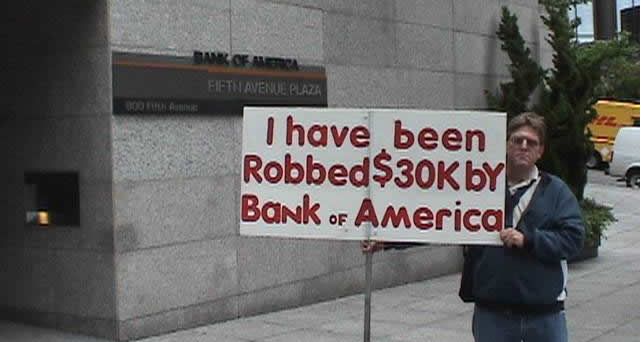

A man sued bank of america for erroneously foreclosing on his home and won when they didn t pay the fees he foreclosed their bank

Man Sues Bank of America and Successfully Forecloses Their Bank After Erroneous Foreclosure

In a stunning turn of events, a man sued Bank of America for wrongfully foreclosing on his home and emerged victorious. But when the bank failed to pay the required fees, he took drastic measures by foreclosing their own bank. This extraordinary story not only highlights the power of justice but also serves as a reminder of the importance of accountability for even the largest financial institutions.

According to ABC News, the chain of events began when Florida resident Warren Nyerges discovered that Bank of America had mistakenly foreclosed on his fully paid-off home. Shocked and outraged by this grave error, Nyerges decided to take legal action against the banking giant. With the help of his attorney, he filed a lawsuit against Bank of America, seeking compensation for the distress caused by the wrongful foreclosure.

The case attracted significant media attention, as it shone a light on the prevalence of foreclosure mistakes and the potential havoc they can wreak on innocent homeowners. As news of the lawsuit spread, it became a symbol of hope for individuals who had faced similar ordeals at the hands of big banks.

After a strenuous legal battle, Nyerges successfully won the lawsuit against Bank of America. The court ruled in his favor, ordering the bank to pay the necessary fees owed to him. However, despite the legal obligation, the bank shockingly refused to fulfill its financial obligations. This left Nyerges with no other recourse but to take matters into his own hands.

In an unprecedented move, Nyerges decided to initiate the foreclosure process on Bank of America’s local branch. Leveraging the same legal procedures that had been used against him, he managed to place a lien on the bank’s property, thereby forcing the branch to confront the consequences of their actions.

The sheer irony of the situation did not go unnoticed, and it sparked widespread discussion and debate regarding the immense power wielded by financial institutions. Many saw Nyerges’ actions as a bold and innovative way of holding such banks accountable for their mistakes, illustrating that even the most powerful entities are not immune to the rules that govern our society.

This extraordinary turn of events serves as a reminder that justice can prevail, even against seemingly insurmountable odds. It showcases the power of perseverance and serves as a warning to financial institutions that accountability should never be taken lightly.

The case of Warren Nyerges against Bank of America has undoubtedly left a lasting impact, resonating with individuals who have experienced the devastating consequences of wrongful foreclosures. Furthermore, it highlights the importance of raising awareness about such issues to foster greater transparency and ensure that individuals are treated fairly in the face of corporate negligence.

Source: ABC News

Related Posts

Quick Links

Legal Stuff